It’s a common problem: First-time home buyers often focus solely on the sticker price of a house when deciding how much they can afford, and then are shocked by all of the other costs associated with homeownership. However, these extra or hidden costs are often the most stressful part about owning a home.

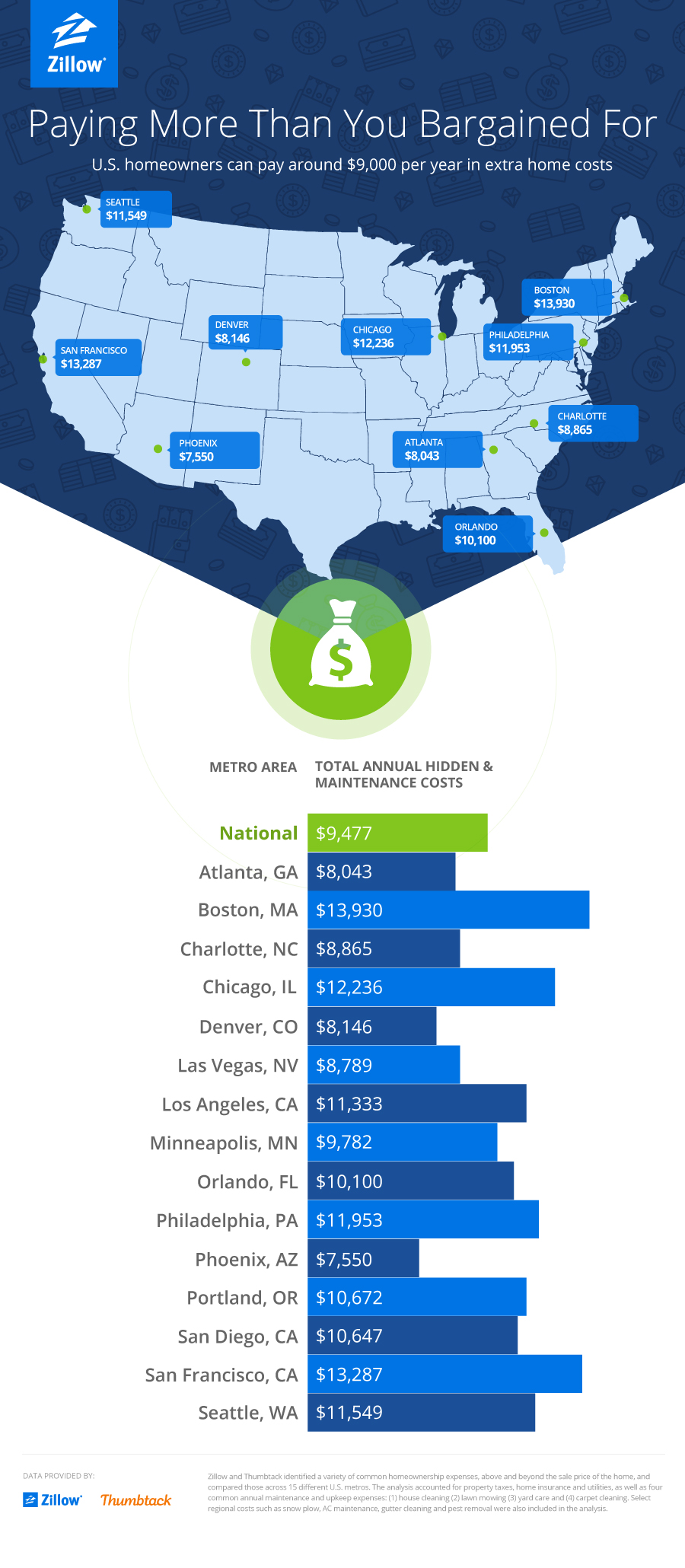

To help buyers better prepare, Zillow and Thumbtack identified a variety of common home expenses — both unavoidable and optional — that often get overlooked during initial budgeting, and calculated what homeowners could spend each year to cover these costs in their area. While these extra expenses might seem small, they quickly add up, costing the average U.S. homeowner more than $9,000 per year.

Beyond principal and interest

Let’s start with the unavoidable. A mortgage calculator can help you estimate your monthly mortgage payment, but if you’re only calculating principal and interest, then you could be underestimating the actual cost of homeownership. That’s because property taxes and homeowners insurance are added to the monthly payment as well. Additionally, while you pay utilities as a renter, if you’re moving into a bigger house, your heat and electric bills will likely increase.

Maintenance costs

Home maintenance is another common expense many buyers overlook. Using Thumbtack data, we identified costs for five popular home maintenance projects, including yard care, carpet cleaning and gutter cleaning. It’s helpful to know how much these types of projects typically cost in your area so you can plan accordingly, even if you, like many homeowners, prefer a DIY approach for these projects (and if that’s the case, remember to budget for trips to the hardware store to buy a lawn mower or other tools).

Location, location, location

As with all things real estate, these extra costs can vary significantly by region. In Boston, homeowners can pay nearly $14,000 annually for these combined hidden costs and maintenance expenses — the highest in the markets analyzed. Compare that to Phoenix, where homeowners pay almost half ($7,550) for the same costs.

Curious how other areas stack up? Check out the graphic below for a breakdown of the 15 metros analyzed in the report.

from Zillow Blog - Real Estate Market Stats, Celebrity Real Estate, and Zillow News http://feedproxy.google.com/~r/ZillowBlog/~3/er475j9UyZI/

via Reveeo

No comments:

Post a Comment