Skyler Dormier’s student loan payment is a doozy.

A federal employee in Seattle, he spends just over $1,000 a month to repay loans tied to his bachelor’s and master’s degrees.

“I think of it as a car payment,” said Dormier, who will soon pay off his bachelor’s degree debt and have a lower payment. “Instead of a stupid car that’s devaluating, it’s a degree that helps me increase my income down the line. It’s a car payment that’s paying me back."

Turns out he's right.

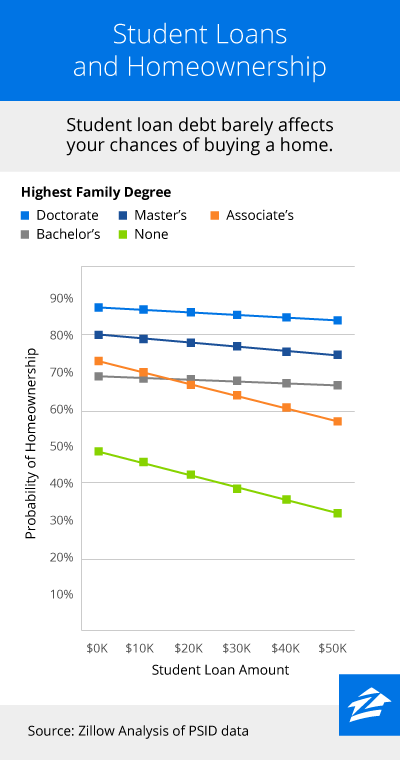

Despite widespread concern that student debt hinders home buying, new research from Zillow shows that as long as people complete at least a four-year degree, the effect of student debt on their chances of owning a home is negligible.

Dormier bought a home after graduating with his bachelor’s degree and swapped it for another one after adding $44,000 in student loans from a master’s degree in design ethnography.

There's a 70-percent chance that people with medical, law and doctoral degrees will own a home. That likelihood is 66 percent with master's degrees, 61 percent with bachelor's degrees, and 56 percent with associate's degrees.

There's a 70-percent chance that people with medical, law and doctoral degrees will own a home. That likelihood is 66 percent with master's degrees, 61 percent with bachelor's degrees, and 56 percent with associate's degrees.

A distant fifth are people with no degree at all; they own their homes just 30 percent of the time. If they have student debt – but never graduated – their chances of owning a home are even lower.

Sensitivity to student debt is considerably higher for people who have only an associate's degree or no college degree at all, according to a Zillow analysis of the 2013 Panel Study of Income Dynamics. (We used average income and wealth figures for each degree profile, and assumed people were 33 years old and married with children.)

“As total student debt continues rising, there is general apprehension that this trend may prevent millennials from buying homes," said Zillow Chief Economist Svenja Gudell.

"But our research helps put these fears to rest to some degree, because as long as accumulating that debt actually does result in getting a degree, debt itself is not quite the obstacle to homeownership that conventional wisdom makes it out to be,” Gudell continues. “Certainly, it's better to accumulate debt and finish your degree than it is to accumulate debt but have nothing to show for it in the end. In other words, if eventually owning a home is a priority for you and you're currently pursuing higher education: Don't be a fool, stay in school.”

The down payment is the tricky part, according to Dormier and others with student debt.

If it weren’t for an inheritance from his partner’s grandmother, “I’d probably still be renting from the awesome landlord I had before 2009,” he said.

Fred Moll, a public defense lawyer in Washington State, knows the feeling.

He knows another defense attorney who’s spending his sabbatical working for a large tech company to get a down payment for a house. Another lawyer he knows moved back home for a year or two to save up.

Someone with a law or doctoral degree and $40,000 in student loans has an 84-percent chance of owning a home. Carrying that same degree but being $100,000 in debt decreases the probability to an 80-percent chance.

Moll falls into the high-debt category, with $100,000 in loans out of law school.

He bought a house five years later - with a down payment he inherited when his mother passed away.

“I like the house a lot,” Moll said. “But it was an unfortunate way to get the money.”

For more about Zillow’s student debt report, check out Zillow Research.

Related:

- Hyper-Gentrification Comes to Miami

- Looking to Buy? Home Values Are Dropping in These Markets

- The Age of Homes in All 50 States

from Zillow Blog - Real Estate Market Stats, Celebrity Real Estate, and Zillow News http://www.zillow.com/blog/student-debt-effect-homeownership-182547/

via Reveeo

No comments:

Post a Comment